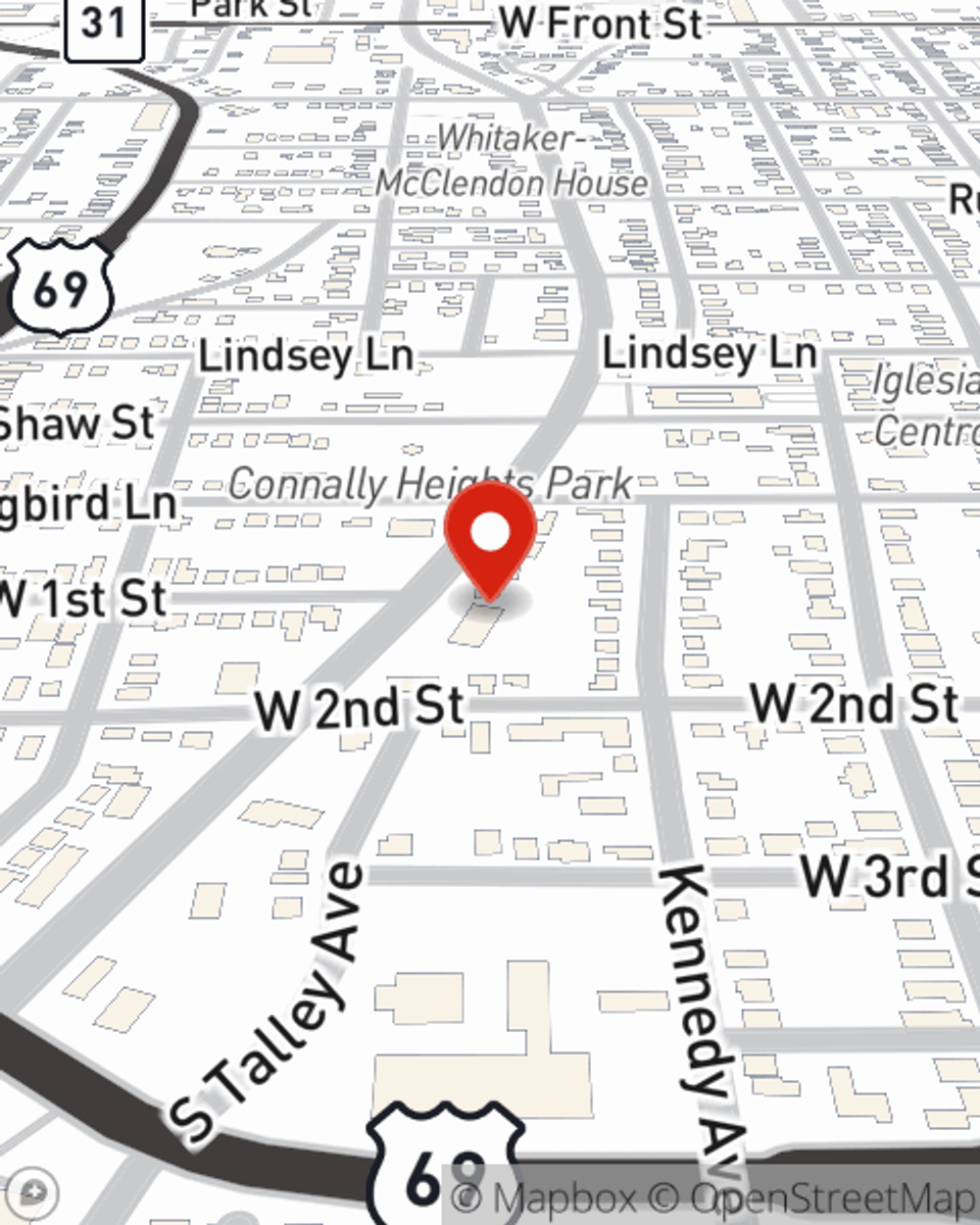

Renters Insurance in and around Tyler

Get renters insurance in Tyler

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Arp

- Ben Wheeler

- Brownsboro

- Bullard

- Chandler

- Flint

- Frankston

- Lindale

- Overton

- Troup

- Whitehouse

- Winona

- Texas

- Henderson

- Tyler

- Gilmer

- Gladewater

- Longview

- Kilgore

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or apartment, renters insurance can be a good idea to protect your personal property, including your laptop, golf clubs, video games, books, and more.

Get renters insurance in Tyler

Coverage for what's yours, in your rented home

There's No Place Like Home

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't include your personal belongings. Renters insurance helps shield your personal possessions in case of the unexpected.

More renters choose State Farm® for their renters insurance over any other insurer. Tyler renters, are you ready to see how helpful renters insurance can be? Get in touch with State Farm Agent John Merrill today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call John at (903) 597-1994 or visit our FAQ page.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

John Merrill

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.